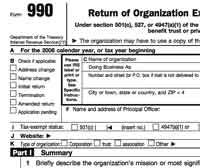

It is no surprise that the IRS has identified UBIT compliance as a priority for 2012. With government funding and private donations decreasing during the recession years, exempt organizations reportedly stepped up unrealted business activities to supply needed revenues. Also, the redesigned Form 990, Return of Organization Exempt from Income Tax, effective in 2008, now provides the IRS with information it can use to identify exempt organizations which are engaging in activities that may generate UBTI. Form 990-T, Exempt Organization Business Income Tax Return, is used to report the UBIT.

It is no surprise that the IRS has identified UBIT compliance as a priority for 2012. With government funding and private donations decreasing during the recession years, exempt organizations reportedly stepped up unrealted business activities to supply needed revenues. Also, the redesigned Form 990, Return of Organization Exempt from Income Tax, effective in 2008, now provides the IRS with information it can use to identify exempt organizations which are engaging in activities that may generate UBTI. Form 990-T, Exempt Organization Business Income Tax Return, is used to report the UBIT.

In its 2011 Annual Report & 2012 Work Plan, released on February 8, 2012, the Exempt Organizations section of Tax Exempt and Government Entities announced that it would use the information on Form 990 for UBIT compliance to identify organizations that reported unrelated business activities on Form 990 but did not file a Form 990-T. In addition,the IRS proposes to analyze Form 990-T data to develop risk models to identify organizations that consistently report significant gross receipts from unrelated businesses but also report no tax due. Cryptically, the Work Plan also states that the IRS will use its analyses of the Forms 990 and 990-T “in connection with a coming UBIT project.” Continue reading