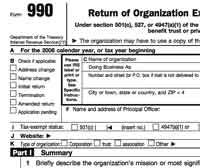

It is no surprise that the IRS has identified UBIT compliance as a priority for 2012. With government funding and private donations decreasing during the recession years, exempt organizations reportedly stepped up unrealted business activities to supply needed revenues. Also, the redesigned Form 990, Return of Organization Exempt from Income Tax, effective in 2008, now provides the IRS with information it can use to identify exempt organizations which are engaging in activities that may generate UBTI. Form 990-T, Exempt Organization Business Income Tax Return, is used to report the UBIT.

It is no surprise that the IRS has identified UBIT compliance as a priority for 2012. With government funding and private donations decreasing during the recession years, exempt organizations reportedly stepped up unrealted business activities to supply needed revenues. Also, the redesigned Form 990, Return of Organization Exempt from Income Tax, effective in 2008, now provides the IRS with information it can use to identify exempt organizations which are engaging in activities that may generate UBTI. Form 990-T, Exempt Organization Business Income Tax Return, is used to report the UBIT.

In its 2011 Annual Report & 2012 Work Plan, released on February 8, 2012, the Exempt Organizations section of Tax Exempt and Government Entities announced that it would use the information on Form 990 for UBIT compliance to identify organizations that reported unrelated business activities on Form 990 but did not file a Form 990-T. In addition,the IRS proposes to analyze Form 990-T data to develop risk models to identify organizations that consistently report significant gross receipts from unrelated businesses but also report no tax due. Cryptically, the Work Plan also states that the IRS will use its analyses of the Forms 990 and 990-T “in connection with a coming UBIT project.”

How Can the IRS Use Information Reported on Form 990 to Enforce the UBIT?

Section VIII of Form 990 requires an exempt organization to list all sources of revenue for the taxable year. Line 2 is for program service revenue, which is revenue received by the organization in carrying out its exempt purposes. The top five largest sources of program service revenue are identified in lines 2a through 2e; all other program services revenue are lumped together on line 2f. Lines 6 through 10 refer to specific income-producing activities, such as rentals, sales, fundraising, and sales of non-inventory assets. Miscellaneous revenues are entered on line 11.

Entries on lines 2a through 2f and lines 11a through 11d must be accompanied by a business code. Common business codes are found in Appendix J to the Instructions for Form 990. A more detailed list of business codes is set forth on the North American Industry Classification System (NAICS) website. For example, a museum that operates a gift shop would list the gross receipts from the gift shop and specify a business code of 453220 — Gift, novelty, and souvenir stores.

Furthermore, Form 990 requires an exempt organization to indicate the extent to which the amount of each business income entry is:

● Related or exempt function revenue

● Unrelated business revenue

● Revenue excluded from tax under §§512, 513, or 514

Part IX of Form 990 requires a statement of functional expenses. For each category of expenses, an organization must indicate how much represents program service expenses, management and general expenses, or fundraising expenses. Somewhat unexpectedly, at least some expenses associated with unrelated business activities are reported under the column for program service expenses.

By examining an exempt organization’s Form 990, the IRS can easily tell whether the organization reported receiving income subject to the UBIT by looking at column (C) of Part VIII. The IRS can also identify by column (D) the amount of income that the organization believes is excluded from the tax under §§512, 513, or 514. In contrast, in the Statement of Expenses in Part IX, expenses attributable to unrelated business activities are not specifically delineated. If an organization reports substantial income from unrelated business activities on Form 990 but does not file a Form 990-T, or files a Form 990-T but reports no tax due, the inconsistency will likely raise a red flag if the IRS follows the 2012 Work Plan.

For a discussion of other IRS priorities for 2012 involving exempt organizations, see Ellis Carter, IRS 2012 Work Plan — What’s New for Nonprofits.